Driver Qualification File Management

Simplify one of fleet compliance’s most complex requirements by centralizing records, tracking expirations, and keeping every driver audit-ready.

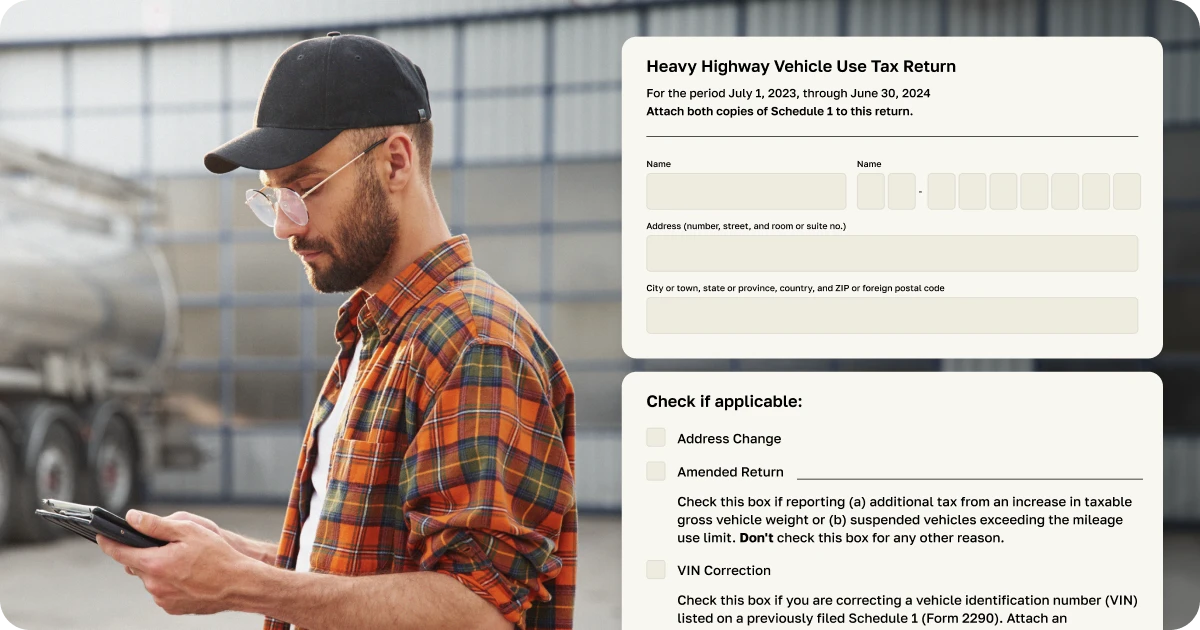

Learn MoreFleetworthy helps fleets file Form 2290 accurately and on time so vehicles stay cleared for registration and fleets meet IRS heavy vehicle use tax requirements.

Track which vehicles exceed IRS taxable weight thresholds and require Form 2290 filing for the tax year.

Easily submit your Form 2290 electronically and receive IRS-stamped Schedule 1 confirmation upon acceptance.

Monitor filing progress and acceptance status for each vehicle and tax year in one centralized view.

Store and retrieve IRS-stamped Schedule 1 documents by vehicle, VIN, and tax year.

Track amended filings, including VIN corrections and suspensions, with clear submission history and expert support from the Fleetworthy team.

File securely via ExpressTruckTax by Fleetworthy

Get unmatched toll road coverage, smart reporting and centralized billing, automated misread identification service (A.M.I.S), and maximized toll discounts.

Vehicles that exceed IRS taxable weight thresholds for the tax year are required to file Form 2290.

Fleetworthy provides access to IRS-stamped Schedule 1 documents confirming filing acceptance.

Yes. Amended filings support VIN corrections and vehicle suspensions with tracked submission history.

VIN validation and taxable vehicle tracking help reduce errors before submission to the IRS.

Fleetworthy submits Form 2290 electronically and tracks acceptance and confirmation digitally.